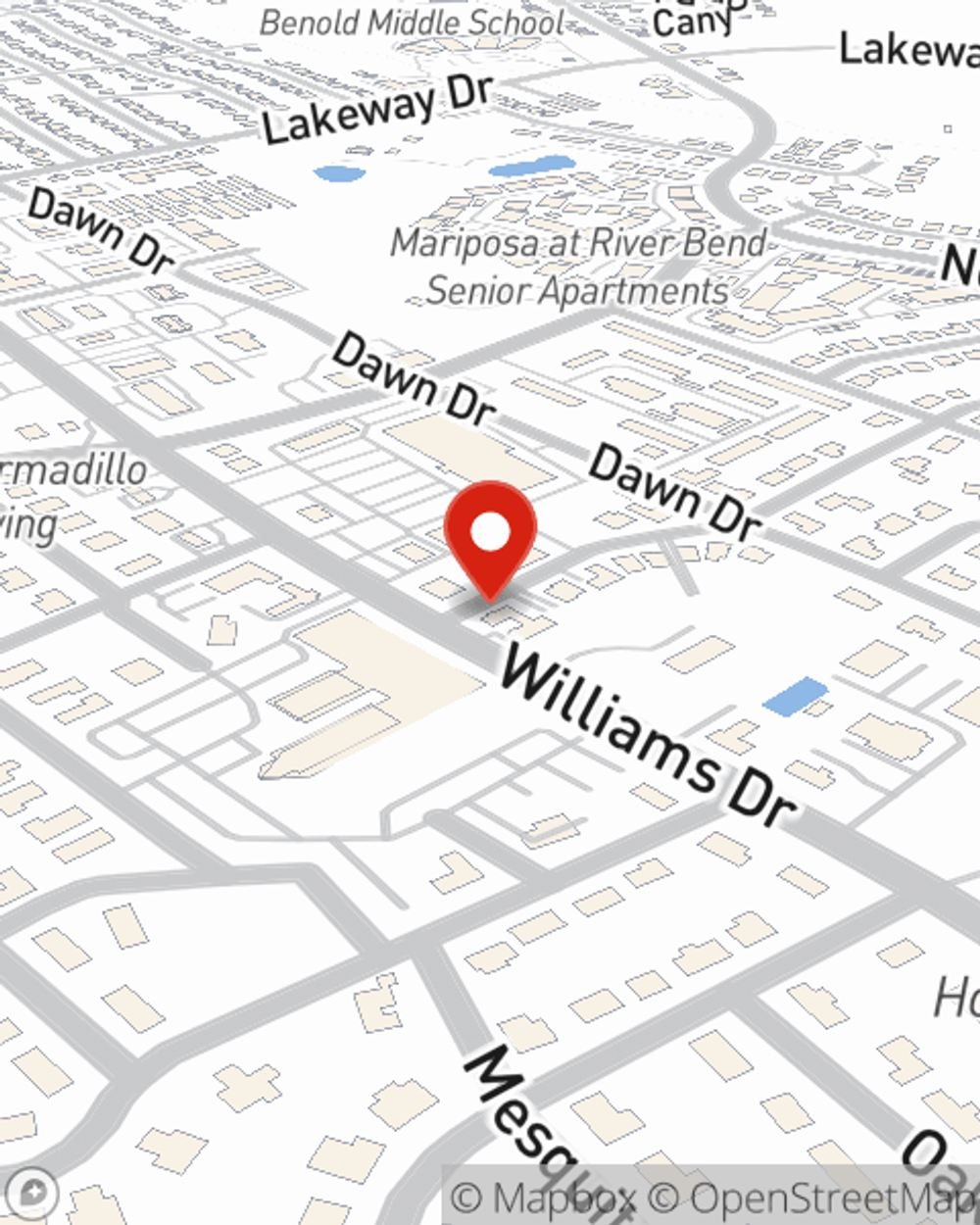

Life Insurance in and around Georgetown

Coverage for your loved ones' sake

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Georgetown

- Round Rock

- Jarrell

- LIberty Hill

- Taylor

- Leander

- Cedar Park

- Hutto

- Florence

- Sun City

Protect Those You Love Most

It can be a big responsibility to provide for your partner, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that the people you love can keep paying for your home and/or pay off debts as they grieve your loss.

Coverage for your loved ones' sake

Life won't wait. Neither should you.

Life Insurance You Can Trust

You’ll get that and more with State Farm life insurance. State Farm has outstanding protection plans to keep your family members safe with a policy that’s adjusted to correspond with your specific needs. Thank goodness that you won’t have to figure that out on your own. With deep commitment and excellent customer service, State Farm Agent Don Homeyer walks you through every step to build a policy that covers your loved ones and everything you’ve planned for them.

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to check out what a State Farm policy can do for you? Visit State Farm Agent Don Homeyer today.

Have More Questions About Life Insurance?

Call Don at (512) 930-5500 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Don Homeyer

State Farm® Insurance AgentSimple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.